Hi Greg, It has been over a week since you said the Rotax order form would be available. Any update? Thanks!It will be available by Monday afternoon.

Van's Air Force

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Engine, Prop and Avionics Update posted

- Thread starter Brantel

- Start date

We were in the process of uploading them when you posted. The RV-12iS order forms are now available on the "Order a Kit" page.Hi Greg, It has been over a week since you said the Rotax order form would be available. Any update? Thanks!

What about the Sensenich form?We were in the process of uploading them when you posted. The RV-12iS order forms are now available on the "Order a Kit" page.

Sensenich prop order form (for the RV-12iS) is on the RV-12iS power plant order form.What about the Sensenich form?

I was asking for the other models.Sensenich prop order form (for the RV-12iS) is on the RV-12iS power plant order form.

Hi @greghughespdx,

Thanks for trying to answer all questions on top of everything that is going on.

I truly think it is about time engine buyers get more transparency on what is going on between Vans and Lycoming. I understand most of the reorders are in place and someone in Lycoming must know their current engine delivery capabilities and timelines. Why not share this with end customers? We all have our own timelines to fulfill and projects to move on with.

I have emailed Lycoming a few times in the last months and the response is always, "waiting for Vans"... Checking with Vans parts team the reply was "wait" until last month and now it changed to "depends on Lycoming"...

When the chapter 11 was filed, did Lycoming stopped production, afraid Vans wouldn't honor the orders? sounds unlikely. Should we expect the engines to be delivered roughly at the previous informed dates plus a couple of months?

Appreciate any input so we can plan our timelines better.

Thanks

Thanks for trying to answer all questions on top of everything that is going on.

I truly think it is about time engine buyers get more transparency on what is going on between Vans and Lycoming. I understand most of the reorders are in place and someone in Lycoming must know their current engine delivery capabilities and timelines. Why not share this with end customers? We all have our own timelines to fulfill and projects to move on with.

I have emailed Lycoming a few times in the last months and the response is always, "waiting for Vans"... Checking with Vans parts team the reply was "wait" until last month and now it changed to "depends on Lycoming"...

When the chapter 11 was filed, did Lycoming stopped production, afraid Vans wouldn't honor the orders? sounds unlikely. Should we expect the engines to be delivered roughly at the previous informed dates plus a couple of months?

Appreciate any input so we can plan our timelines better.

Thanks

Dugaru

Well Known Member

True transparency might just yield a big question mark. I think there’s a real possibility that Vans just doesn’t know very much about how much time it will take for Lycoming to build and deliver engines. And there’s a definite chance that Lycoming doesn’t know much about that, either.I truly think it is about time engine buyers get more transparency on what is going on between Vans and Lycoming.

Greg,

Some folks are sitting on theirhands because they think Vans is going the end up CH7.

I suspect with 60 percent plus acceptance it is going ok.

If CH11 is going fine then perhaps Vans can put out a business update before the ordering window closes?

---------------------------------------------------------------------------------------------------------------

When the next court date? Is this after all contracts must be signed ?

Some folks are sitting on theirhands because they think Vans is going the end up CH7.

I suspect with 60 percent plus acceptance it is going ok.

If CH11 is going fine then perhaps Vans can put out a business update before the ordering window closes?

---------------------------------------------------------------------------------------------------------------

When the next court date? Is this after all contracts must be signed ?

I’d say it’s a safe bet to add 6+ months to whatever you heard last. Lycoming had their own backup issues last year that I detailed in an earlier post. I’m sure Lycoming is anxious to get production and money flowing.

I called a Lycoming distributor yesterday and was told a new Thunderbolt order was 4 YEARS. Sounded a little far fetched but maybe not.

I have been hand ringing. Admittedly upset, highly critical of the entire process. I have put more thought into the engine reorder. I think I may lose more by not reordering. I hate to admit it but it’s an ugly truth for me.

Making a claim, I’m really unsure what the eventual pay out would be. .50 on the dollar would probably be pie in the sky. The amount remaining lost is roughly the same as the extra 12% I’d have to pony up. If they chapter 7 then it’s all gone anyway.

I’m maneuvering this turd sandwich for the biggest bite of bread and least amount of turd per bite.

I called a Lycoming distributor yesterday and was told a new Thunderbolt order was 4 YEARS. Sounded a little far fetched but maybe not.

I have been hand ringing. Admittedly upset, highly critical of the entire process. I have put more thought into the engine reorder. I think I may lose more by not reordering. I hate to admit it but it’s an ugly truth for me.

Making a claim, I’m really unsure what the eventual pay out would be. .50 on the dollar would probably be pie in the sky. The amount remaining lost is roughly the same as the extra 12% I’d have to pony up. If they chapter 7 then it’s all gone anyway.

I’m maneuvering this turd sandwich for the biggest bite of bread and least amount of turd per bite.

Last edited:

DanNiendorff

Well Known Member

Unfortunately I don’t think Greg can provide an answer, because there probably is no answer yet. No deal with Lycoming has been announced. The engine contract offered is structured as an offer to buy at a projected price pending completion of negotiations with Lycoming. I don’t think it is a stretch to conclude that Vans and Lycoming have not yet reached an agreement.

I understand the offered price to be Vans best guess at what they will need to get from buyers in order to complete the orders they expect to convert at the new price. More (or less) conversions will affect the actual price eventually charged, as well lead times. Since each engine deposit represents an obligation for Vans, fewer orders would have a favorable effect on the eventual price (less lost deposits to cover)….. of course that may be just the opposite on the kit side of the equation. Timing is completely unknown until an agreement is reached.

Absolutely there is a good faith effort from Vans, but they cannot tell you what is not yet known.

I understand the offered price to be Vans best guess at what they will need to get from buyers in order to complete the orders they expect to convert at the new price. More (or less) conversions will affect the actual price eventually charged, as well lead times. Since each engine deposit represents an obligation for Vans, fewer orders would have a favorable effect on the eventual price (less lost deposits to cover)….. of course that may be just the opposite on the kit side of the equation. Timing is completely unknown until an agreement is reached.

Absolutely there is a good faith effort from Vans, but they cannot tell you what is not yet known.

NavyS3BNFO

Well Known Member

Absolutely there is a good faith effort from Vans, but they cannot tell you what is not yet known.

I think what most people miss or don't understand is that "Vans" as we know it, is not in charge. There is an entirely new management team whose only job is to get the company through Ch11. Then add in the attorneys and court and you're not dealing with the old Vans we are used to where you could call up and they could make accommodations and changes on the fly. This is a transaction for the restructuring team, not a long term relationship - for better or worse.

DanNiendorff

Well Known Member

I think what most people miss or don't understand is that "Vans" as we know it, is not in charge. There is an entirely new management team whose only job is to get the company through Ch11. Then add in the attorneys and court and you're not dealing with the old Vans we are used to where you could call up and they could make accommodations and changes on the fly. This is a transaction for the restructuring team, not a long term relationship - for better or worse.

I agree with you completely on this. It might have been more accurate to say that Greg and co. are acting in good faith….. but are no longer in control.

I am sure everyone is acting in good faith and looking forward to have products out and money in. What does not make sense to me is why is Lycoming planning capabilities impacted by Vans Ch11?

From Lycoming point of view, they have binding orders from Vans. black and white. If Lycoming decide to slow down production because they feared the risk Vans business was imposing, this is on them. not Vans.

Lycoming should be able to tell the forecast of the orders, regardless of Vans situation. And, now that we do have more clarity on the Vans side, Lycoming risks is reduced. (This is assuming the scenario where Lycoming Engines would be stuck, which is completely not happening).

Anyway, long story short. There is no reason in my view for Lycoming to slow down or hold back production. And no reason to avoid giving us prospective delivery dates. I assume there are many builders like me who already got the "new order confirmation".

From Lycoming point of view, they have binding orders from Vans. black and white. If Lycoming decide to slow down production because they feared the risk Vans business was imposing, this is on them. not Vans.

Lycoming should be able to tell the forecast of the orders, regardless of Vans situation. And, now that we do have more clarity on the Vans side, Lycoming risks is reduced. (This is assuming the scenario where Lycoming Engines would be stuck, which is completely not happening).

Anyway, long story short. There is no reason in my view for Lycoming to slow down or hold back production. And no reason to avoid giving us prospective delivery dates. I assume there are many builders like me who already got the "new order confirmation".

DanNiendorff

Well Known Member

I don’t think this is the cases. CH 11 allows vans to modify contracts with its creditors - including Lycoming. Lycoming (like us) may agree or not. I am concluding that this is still being negotiated, and no agreement has been made yet.From Lycoming point of view, they have binding orders from Vans. black and white.

This a confirmation of your offer to purchase from Vans. Vans will not accept it until they can deliver at that price (or a new price TBD). And that all depends on their negotiations with Lycoming.I assume there are many builders like me who already got the "new order confirmation".

Bottom line to me - the Vans / Lycoming card game is not over yet. And no one will guarantee cost or timeline until it is.

Ch 11 allows Van's to modify or cancel previously agreed upon contracts. It does not let them modify new contracts going forward. Van's had a number of execs at Lycoming a couple weeks ago to hammer out pricing details. I don't believe that the court would allow Van's to proceed with modified engine orders if they didn't have a solid deal with Lycoming at this point. I may be naive, but I accepted my new order details based on the details provided to me and I fully expect Van's and Lycoming to ship me an engine when it's ready for the agreed upon price. Now when that is...?I don’t think this is the cases. CH 11 allows vans to modify contracts with its creditors - including Lycoming. Lycoming (like us) may agree or not. I am concluding that this is still being negotiated, and no agreement has been made yet.

This a confirmation of your offer to purchase from Vans. Vans will not accept it until they can deliver at that price (or a new price TBD). And that all depends on their negotiations with Lycoming.

Bottom line to me - the Vans / Lycoming card game is not over yet. And no one will guarantee cost or timeline until it is.

DanNiendorff

Well Known Member

I accepted my new order details based on the details provided to me and I fully expect Van's and Lycoming to ship me an engine when it's ready for the agreed upon price.

Maybe your agreement was different than the one I was presented. The one I received was an “offer to buy” at the listed price, which Vans could accept, modify, or reject at a later time, contingent on a deal with Lyc.

I am not saying this is a bad deal. It’s probably the best option for most. But it is an article of faith……. which includes no timelines.

As far as an established deal between Vans and Lyc? If it were presented to the court it would be public. And I am not aware of it (I could have missed it?). Certainly Vans and Lyc are both behaving as if the card game is still going….

Okay, but look from this angle: Through Vans or not, do you really think Lycoming had any risk of not selling those engines? If Vans disappears tomorrow, there will be another distributor to review the contracts and fulfill orders of former Vans clientele, for sure.I don’t think this is the cases. CH 11 allows vans to modify contracts with its creditors - including Lycoming. Lycoming (like us) may agree or not. I am concluding that this is still being negotiated, and no agreement has been made yet.

This a confirmation of your offer to purchase from Vans. Vans will not accept it until they can deliver at that price (or a new price TBD). And that all depends on their negotiations with Lycoming.

Bottom line to me - the Vans / Lycoming card game is not over yet. And no one will guarantee cost or timeline until it is.

Why would Lycoming stop producing the engines?

THIS MATTER having come before the Court on Debtor's Motion to Hold CustomerJust because the judge ordered them to use a separate account does not necessarily mean it is not their asset to do with as they please. You may be right, but that is a question for an attorney. Once they are out of chap 11, there is no court involvement. The law and judges instructions are full of twists and turns with all sorts of case law and precedence.. The reality is that the bank account holding the money is registered to vans and therefore a Vans asset, so not sure how anyone could make an argument that the $ belongs to anyone but vans. With an escrow, the $ is held in an account registered to someone other than either of the parties involved in the transaction with legal documents spelling out condition for asset transfer.

Deposits in Trust [ECF No. 8]; now therefore,

IT IS HEREBY ORDERED that:

1. Debtor is authorized to maintain a separate and segregated account in which it

will deposit Customer Deposits (as defined in the Motion) to hold customer deposits in trust for

the respective customer as set forth in the Motion.

2. Funds held in trust will only become property of Debtor’s estate after such funds

have been applied consistent with the New Deposit Practice (as defined in the Motion) as set

forth on the new customer order agreements.

# # #

Below is an order of the court.

_______________________________________

DAVID W. HERCHER

U.S. Bankruptcy Judge

In this order, "Customer Deposits" includes only those deposits that debtor segregated in

accordance with the Deposit Practice described in Motion paragraph 5 or that debtor received in

accordance with the New Deposit Practice described in Motion paragraph 8.

U.S. BANKRUPTCY COURT

DISTRICT OF OREGON

F I L E D

December 08, 2023

Clerk, U.S. Bankruptcy Court

Case 23-62260-dwh11 Doc 31 Filed 12/08/23

DanNiendorff

Well Known Member

I agree with you on this. Assuming that they had capacity, it would make sense to produce them, as they will be sold. Of course they also want the best price for them. And the outcome of this negotiation will define a large part of their business expectations and margins going forward. So they want to get their best deal. In seeking their best deal it is against their interest to promise a timeline….. they have to hold out the possibility that a deal won’t happen. If they promise a timeline it is essentially saying to Vans that they have already concluded that the negotiations will succeed, regardless of the terms. That is not in Lycoming’s interest. So I agree with you that they may be sitting on completed engines, possibly. But they won’t promise a delivery until terms are agreed upon with Vans. May it be soon.Okay, but look from this angle: Through Vans or not, do you really think Lycoming had any risk of not selling those engines? If Vans disappears tomorrow, there will be another distributor to review the contracts and fulfill orders of former Vans clientele, for sure.

Why would Lycoming stop producing the engines?

ccarlson

Well Known Member

Disregard. I received my answer today from Ryan at AeroLeds via mass email.Hi Greg,

Before I say anything else, I want to thank you for chiming in this evening with what I think may be the best & most sincere set of comms produced on Van’s behalf (that I’ve seen/read) since May 2023.

With regard to backordered items, and I do apologize if I’ve missed this elsewhere, do the lists of backordered items include Aerosun VXi wingtips ordered (and paid in full) with wing kits?

Lucky me - I didn’t even get a chance to agree to updated terms. Instead, I got sent straight to claimsville… a.k.a. paid $3,600 for a lottery ticket worth maybe what… $360 (if I’m lucky)? I am so done with this.

Brantel

Well Known Member

Greg,

@greghughespdx

It would be nice to see an update to the percentage of folks that have accepted the modified orders.

@greghughespdx

It would be nice to see an update to the percentage of folks that have accepted the modified orders.

Agreed. Lycoming knows that planes are still flying, still being built, still need engines. The distributor/retailer my change, but the demand did not.I don’t think Lycoming sat on their hands waiting for Vans during the last months.

They most likely built whatever orders that were NOT Vans orders. Those folks got sped up. They are also out of the way.

Vans isn’t the only Lycoming customer.

If Van's were to fold and all current kit construction came to a halt, Lycoming well knows that engine demand would plummet. Keep in mind that Van's is their number one customer.Agreed. Lycoming knows that planes are still flying, still being built, still need engines. The distributor/retailer my change, but the demand did not.

Greg,

Some folks are sitting on theirhands because they think Vans is going the end up CH7.

I suspect with 60 percent plus acceptance it is going ok.

If CH11 is going fine then perhaps Vans can put out a business update before the ordering window closes?

---------------------------------------------------------------------------------------------------------------

When the next court date? Is this after all contracts must be signed ?

I would like to believe that too but the December operating report has been put out by Vans a couple of days ago and shows a loss 440k larger than they had expected. I have not seen a single projection filed with the court which would make them cash flow positive before running out of DIP funding nor has anybody in court made a statement that they wouldn’t. That doesn’t instill a lot of confidence.

The good news is that the same report shows some post filing payments to Lycoming. So Lycoming is selling and Vans is buying engine. Volume was much lower then pre filling. Not sure if that is due to Lycoming or to Vans not having enough money to buy more engines. So I am not sure blaming Lycoming is fair without any other info.

Oliver

If I had a stake in this, that operating report would be the primary driver on weather I sent vans more money or not. January's report will likely paint the picture of vans survival. I would assume vans is getting little to no new orders. And I'd think by the end of January most will have accepted and paid or bailed and claimed on existing kit orders.I would like to believe that too but the December operating report has been put out by Vans a couple of days ago and shows a loss 440k larger than they had expected. I have not seen a single projection filed with the court which would make them cash flow positive before running out of DIP funding nor has anybody in court made a statement that they wouldn’t. That doesn’t instill a lot of confidence.

The good news is that the same report shows some post filing payments to Lycoming. So Lycoming is selling and Vans is buying engine. Volume was much lower then pre filling. Not sure if that is due to Lycoming or to Vans not having enough money to buy more engines. So I am not sure blaming Lycoming is fair without any other info.

Oliver

where is the december results report yall are talking about - i cant find it.

THANKS!

See this post:

Post in thread 'BMC doc 83 - monthly operating report'

https://vansairforce.net/threads/bmc-doc-83-monthly-operating-report.224228/post-1745722

Oliver

BigBadBob

Member

Reports here say that the engine re-order contract is different from the kit re-order contract, and it doesn't appear to be available on the re-order portal unless you have already committed to re-order. Seem like "we have to pass the bill to find out what's in it."

VAN's or anyone else: know where the engine re-order contract can be found so I can do some due-diligence before deciding on re-order?

VAN's or anyone else: know where the engine re-order contract can be found so I can do some due-diligence before deciding on re-order?

DanNiendorff

Well Known Member

You can put it in the cart, and then you will be presented a document to sign. You are able to review it before signing.Reports here say that the engine re-order contract is different from the kit re-order contract, and it doesn't appear to be available on the re-order portal unless you have already committed to re-order. Seem like "we have to pass the bill to find out what's in it."

VAN's or anyone else: know where the engine re-order contract can be found so I can do some due-diligence before deciding on re-order?

Dan 57

Well Known Member

BEWARE

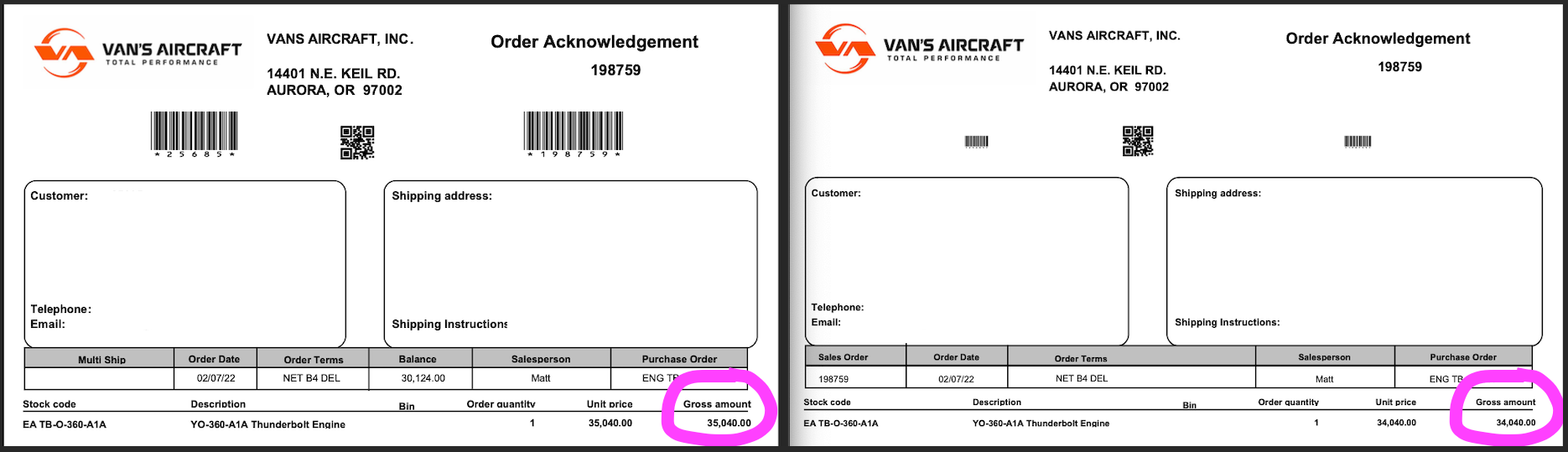

Whilst I'm still on the fence re my engine re-order decision, it came to my attention that the original Gross Amount for my naked TB engine magically increased by 1K! I have notified Van's more than a week ago, radio silence until now...

On the left the $35'040 "new" order acknowledgement, on the right the original for $34'040 which was received when the engine was ordered 02/07/22...

Whilst I'm still on the fence re my engine re-order decision, it came to my attention that the original Gross Amount for my naked TB engine magically increased by 1K! I have notified Van's more than a week ago, radio silence until now...

On the left the $35'040 "new" order acknowledgement, on the right the original for $34'040 which was received when the engine was ordered 02/07/22...

Dan 57

Well Known Member

if the ? is for me, nothing to do with tax since I'm located on the old continent...Were you able to get them to remove the tax on the original order price?

Did they remove the $1,000 discount for ordering the prop at the same time?...the original Gross Amount for my naked TB engine magically increased by 1K!

Dan 57

Well Known Member

Thanks for the hint, but nope, order for the engine only.Did they remove the $1,000 discount for ordering the prop at the same time?

Has to be a mistake, I ordered in March 22 and the old price was stated correctly on in the reorder form and I live in the same country on the old continent…Thanks for the hint, but nope, order for the engine only.

In regard to the future price increases on engine orders, my QB wing reorder contract states the "estimated price is subject to change" so this isn't just a third party (Lycoming) issue. Even with the "estimated" price increase I'm glad I didn't pick up my wings last time I was at Van's to pick up a FWF kit. The wings were sitting there and paid for but Van's had decided "not yet" on letting me take them. My hope is that I end up with a new set of wings with zero LCP.

Dan 57

Well Known Member

Well, as I was having another look at the un-famous Third-Party Component Purchase and Deposit Modification Agreement today, and couldn't help but notice... nothing, no change, i.e. my engine still being quoted at the wrong price on the documents to sign.

Decision moment approaching, I hope someone will notice (yes, I emailed Van's) and amend the proposal...

Hoping I'm the only one with that problem.

Decision moment approaching, I hope someone will notice (yes, I emailed Van's) and amend the proposal...

Hoping I'm the only one with that problem.

Dan 57

Well Known Member

Ok, Van's have again reacted swiftly (they really seem to be working 24/7) and amended my Third-Party Component Purchase and Deposit Modification Agreement with the correct figures, thanks.

Decision time is now approaching fast... wondering what the majority has decided?

Decision time is now approaching fast... wondering what the majority has decided?

Decision time is now approaching fast... wondering what the majority has decided?

I have approached the math of continuing based on writing off the entire deposit and another only half the deposit. (I don’t think anything more then. 50 cents on the dollar is even possible to recover) Add those numbers to the cost of another purchase or the modified Vans offer and assess.Ok, Van's have again reacted swiftly (they really seem to be working 24/7) and amended my Third-Party Component Purchase and Deposit Modification Agreement with the correct figures, thanks.

Decision time is now approaching fast... wondering what the majority has decided?

Finding a “good” engine for overhaul is exactly why I decided to buy new in the first place. Lots of core engines out there that people are too proud of when it comes to price. They’re awful sure the crank is good. When it’s not then that deal becomes not much of a deal anymore.

I predict engine re-orders will be 94%. Not really any good options.Decision time is now approaching fast... wondering what the majority has decided?

Lot of truth here. In todays market I wonder if a core would be better to be fully disassembled, sent out for yellow-tags, and sold as pieces. Parts prices are moving past stupid up into ludicrous.Finding a “good” engine for overhaul is exactly why I decided to buy new in the first place. Lots of core engines out there that people are too proud of when it comes to price. They’re awful sure the crank is good. When it’s not then that deal becomes not much of a deal anymore.

I also went ahead with the engine re-order. The original order was placed just before Chapter 11 was announced so the increase was small and my deposit sufficed with no additional $'s. File a claim or re-order still puts my deposit at risk. I'm am taking the risk of a price increase, a long unknown lead time, and Chapter 7 between crating and receiving. I just put a rebuilt in my Tiger, have another in the works for my Tri-Pacer, and may proceed with one for the RV-7A due to the possible long wait for the engine thru Van's. If Van's does come through, I'll make a decision then of swap or sell. Not happy at all with the situation and confidence not high especially as I see that Van himself filed numerous claims!

I agreed to the new engine and QB wing contracts - and actually got a price reduction after I agreed to the new wing price, but with so many unknowns on RV10 seats it sounds like I need to submit a claim (asap). Does anybody know of a reason that would be a bad idea? Since I agreed to the new engine and wing prices it would seem like crossing my fingers is all that is left to do with those.

Dan 57

Well Known Member

I sure have no clue about US law, but how can you sign an agreement using a deposit made on some goods, and at the same time file a claim to maybe recover some of the same deposit?Does anybody know of a reason that would be a bad idea?

From my simplified vision one would void the other, as in either or, but again, I might be far from the truth.

As for myself I went ahead and now hope the sequence of the original order date will be respected...